A 55+ active lifestyle community is the perfect place for those looking to stay active, engaged, and connected with others. However, location plays a significant role in the affordability and value that such a community can provide. Read on to learn more about the many benefits of becoming a Pennsylvania homeowner in a 55+ community!

What Does it Mean to Be in a 55+ Active Lifestyle Community?

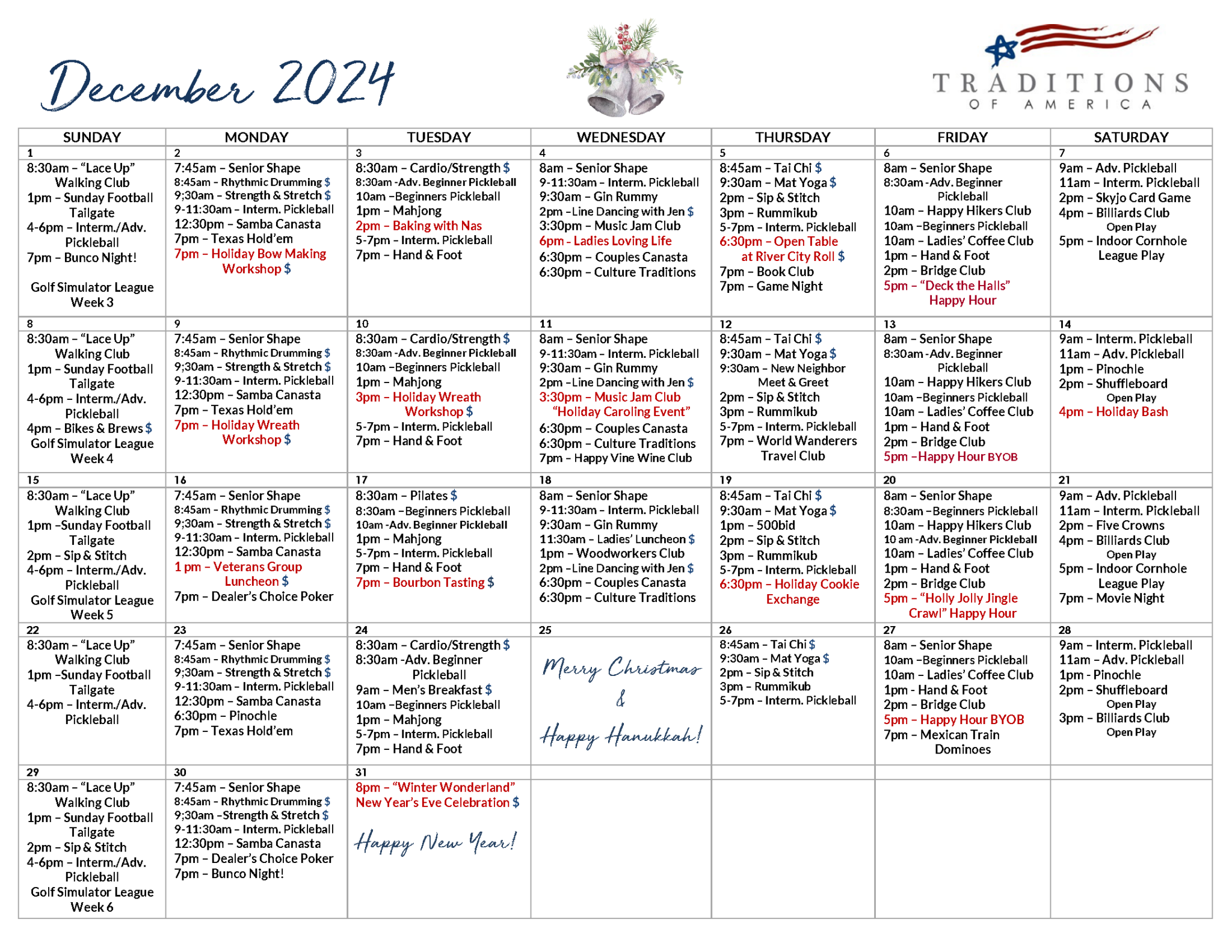

These communities are exclusively designed for individuals aged 55 and above, who are seeking an active and fulfilling lifestyle. At Traditions of America, homeowners can directly collaborate with our professional design team to customize their home as they please. This personalized experience ensures that buyers can turn any house into their own Dream Home. Beyond the homes, every aspect of the community is meticulously planned to ensure that residents feel as stress-free as if they were living at a luxury resort. Homeowners never have to worry about mowing their lawns, raking their leaves, or shoveling snow. With world-class amenities and activities, our communities are designed to maximize fun and enjoyment while minimizing home maintenance!

Benefits of Choosing a 55+ Active Lifestyle Community in PA

One of the primary benefits of choosing a 55+ active adult community in Pa is the potential for greater monetary savings in comparison to neighboring states.

Lower Effective Property Tax Rates: Pennsylvania has a lower effective property tax rate than New York, New Jersey, and Delaware. This means that Pennsylvania homeowners pay a smaller percentage of their home’s value in property taxes each year. In 2022, the effective property tax rate in Pennsylvania was 0.65%, while it was 1.92% in New York, 2.49% in New Jersey, and 0.76% in Delaware.

Lower Median Property Taxes: Pennsylvania homeowners also pay lower median property taxes than homeowners in New York, New Jersey, and Delaware. In 2022, the median property tax in Pennsylvania was $2,210, while it was $7,248 in New York, $5,419 in New Jersey, and $2,318 in Delaware.

More Tax Deductions and Exemptions: Pennsylvania offers a variety of tax deductions and exemptions that can help to reduce property taxes for homeowners. These include deductions for people over the age of 65, veterans, and disabled individuals. Pennsylvania also has a homestead exemption, which exempts a portion of the value of a homeowner’s primary residence from property taxes.

More Predictable Property Tax Assessments: Pennsylvania’s property tax assessment process is more predictable than the assessment processes in New York, New Jersey, and Delaware. This is because Pennsylvania uses a uniform assessment state, which means that all properties are assessed at the same percentage of their market value.

More Transparency in Property Tax Administration: Pennsylvania has a more transparent system of property tax administration than New York, New Jersey, and Delaware. This means that it is easier for homeowners to understand how their property taxes are calculated and how they can challenge their assessments. What’s even better is that Pennsylvania’s proximity to Delaware allows people to take advantage of Delaware’s lack of sales tax with just a short drive over the border.

Who should consider joining a 55+ active lifestyle community in Pennsylvania?

If you are looking for an easy style of living in a customized home with resort-style amenities just beyond the front door, a Traditions of America community may be the perfect pick for you! Each of our communities is filled with people who love living life to the fullest while enjoying everything from pickleball and heated pools to yoga studios and wine tastings. If you are ready to see what our Pennsylvania locations have to offer, be sure to contact our team today.