Many people consider reducing the size of their homes to better align with their lifestyle and financial goals. One increasingly popular option is moving to a 55+ community, where the homes are specifically designed for the desires and needs of active adult homebuyers. Beyond the enhanced social life and access to resort-style amenities, these communities offer significant financial advantages. With lower maintenance costs and reduced property taxes, communities like these empower individuals to manage their budgets more efficiently while still enjoying a vibrant, active lifestyle filled with opportunity.

And, for those who enjoy a little more space, Pinnacle Estates at Brandywine Farms in Chester County, a premier active adult community, redefines carefree estate living. Nestled within tranquil surroundings is this enclave of just 35 expansive homesites, each featuring multi-acre lots and stunning, spacious homes. Featuring highly customizable backyards perfect for entertaining, and unlimited access to top-shelf amenities at the Clubhouse, these homes provide the ideal blend of luxury and convenience, making this community the height of 55+ living.

Lower Maintenance Costs

One of the primary financial benefits of living in an active lifestyle community is the reduced burden of home maintenance. Maintaining a traditional home with extensive yardwork, repairs, and regular upkeep can become both physically challenging and expensive. In these exclusive communities, much of this maintenance is typically handled by the homeowners’ association (HOA) or property management team, which often covers landscaping, exterior repairs, and snow removal.

This shift relieves homeowners from the time-consuming and costly obligations of home upkeep, allowing them to enjoy more leisure time and peace of mind. Additionally, because these homes are designed with efficiency in mind, they tend to have fewer long-term maintenance issues. Owning a more modern home often means fewer repairs and lower utility bills, translating to cost savings that accumulate over time.

Reduced Property Taxes

Another advantage is the potential reduction in property taxes. Larger homes tend to have higher assessed values, resulting in higher property taxes. More smartly designed homes within an age-restricted community can lead to lower property assessments and, consequently, lower taxes. Did you know that Pennsylvania offers a more favorable property tax rate compared to neighboring states like New York, New Jersey, and Delaware? As a result, homeowners in Pennsylvania contribute a lower percentage of their home’s value in annual property taxes, providing potential savings over time.

These tax incentives can provide significant financial relief and help individuals stretch their savings further. Homeowners who move from high-tax areas to regions with lower property taxes, like Pennsylvania, can especially benefit from this financial adjustment.

Lower Utility Bills

Another key financial benefit is the reduction in utility costs. Traditional homes typically require more energy to heat, cool, and light, leading to higher utility bills. By moving to a smartly designed, more energy-efficient home, individuals can significantly reduce their energy consumption and save money on their monthly utility expenses.

Many homes in 55+ communities are built with modern energy-saving features, such as high-efficiency windows, better insulation, and energy-efficient appliances. These features can further reduce electricity and gas usage, leading to additional cost savings.

Streamlined Budgeting and Predictable Costs

Moreover, one of the most appealing aspects is the predictability of costs. Homeowners’ associations in these communities typically charge a monthly fee that covers many essential services, such as maintenance, landscaping, and snow removal. While these fees can vary, they provide a streamlined way to manage household expenses.

This setup eliminates many unexpected costs associated with owning a traditional home, such as emergency repairs or seasonal yardwork, which can disrupt a fixed budget. Knowing exactly how much to allocate each month for housing-related costs provides financial security and allows the active 55+ homebuyer to focus on other aspects of life, such as traveling or hobbies.

Enhanced Social and Active Lifestyles

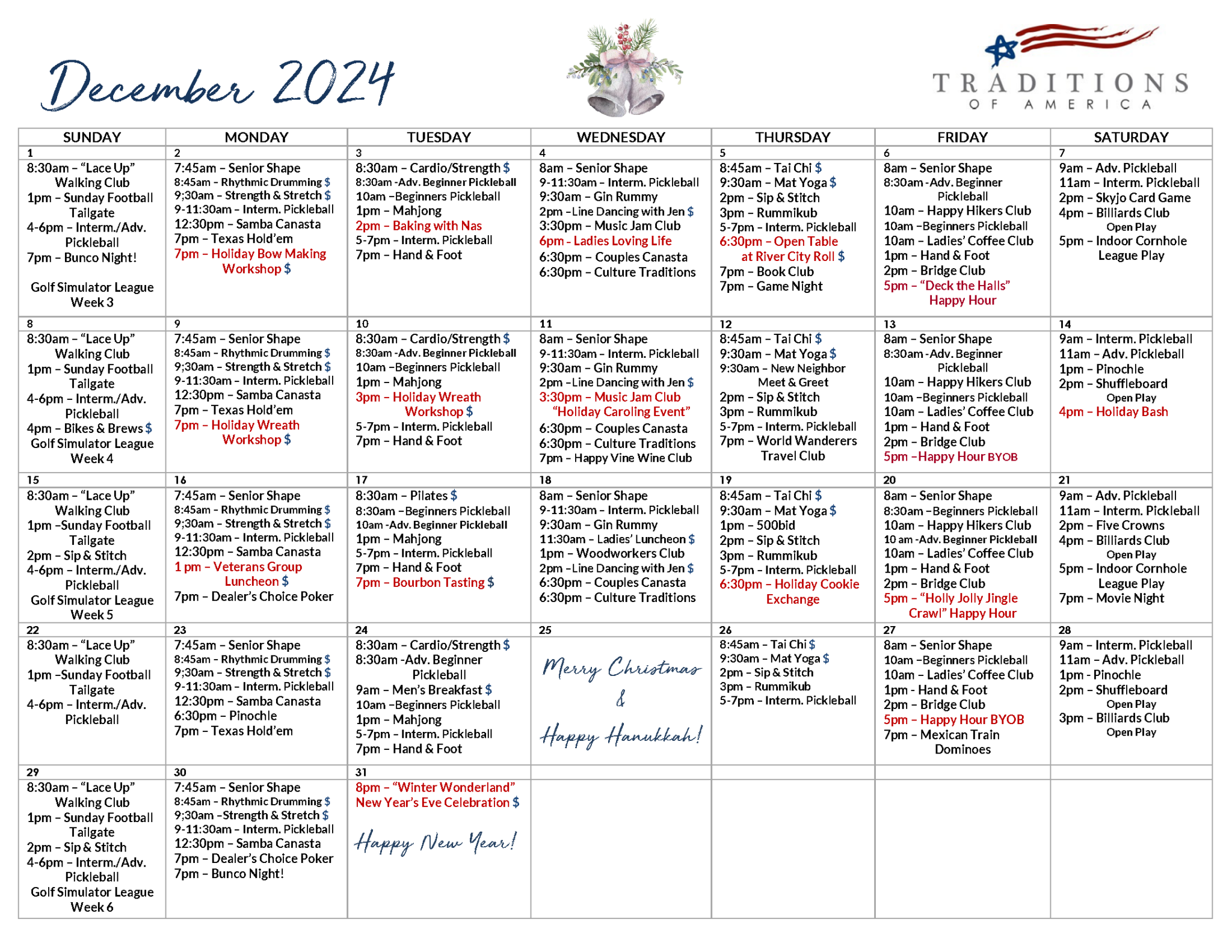

While the financial benefits of moving to an active lifestyle community are significant, the lifestyle advantages should not be overlooked. Many 55+ adults move to these communities not only to reduce the amount of free time spent performing home maintenance but also to live an active, fulfilling life. These communities are designed to foster social engagement, physical activity, and personal enrichment, offering a range of amenities such as fitness centers, heated swimming pools, walking trails, and social clubs.

These amenities can help homeowners stay healthy and active, potentially reducing healthcare costs in the long run. Research has shown that maintaining an active lifestyle and a strong social network can contribute to better physical and mental health as people age. By participating in community events and programs, homeowners can improve their well-being while continuing to enjoy a vibrant lifestyle.

Access to Amenities and Resort Luxuries

Along with engaging social and physical activities, homeowners benefit from easy access to services, such as dog grooming facilities, outdoor grilling areas, or heated pools and spas. For those seeking more activity, homeowners may enjoy walking trails, yoga studios, fitness classes, or pickleball courts. And when it’s time to unwind, homeowners can relax in the sports bar and lounge, try their hand at a round of golf in the golf simulator, or savor a glass in the wine tasting room.

By living in an active adult, resort-style community where these services are readily available, 55+ adults can reduce transportation costs, and other incidental fees. This access to comprehensive services not only enhances one’s social calendar, but also provides financial relief by reducing the need for additional external services.

Long-Term Financial Stability

For many, one of the most important goals of living well is ensuring long-term financial stability during retirement. By reducing housing-related expenses, such as maintenance, utilities, and taxes, consider moving to a 55+ active adult community. Doing so can free up funds for other priorities, such as hobbies, travel, or supporting family members. This approach allows you to live comfortably without the strain of maintaining a traditional home.

In summary, the benefits of moving to a 55+ community are vast. From lower maintenance costs and reduced property taxes to energy savings and predictable expenses, living in an age-restricted community can help individuals manage their budgets more effectively. Coupled with the social, health, and lifestyle advantages, it’s a no-brainer for adults looking to enhance their overall well-being and lifestyle.